Speaking in Parliament December 17, Don Davies, NDP MP for Vancouver Kingsway, said: “The Liberals’ economic update failed to recognize the reality facing working Canadians.” But he also voted for the Standing Committee on Finance report released four days earlier, which included a provision which would harm both the economy and religious organizations. Image from a video of his address.

Roughly 40 percent of all charitable organizations in Canada are religious. Their status was threatened just before Christmas, when the Standing Committee on Finance released its “Pre-Budget Consultations in Advance of the 2025 Budget” in the House of Commons on Friday, December 13.

One of the report’s many recommendations (#430) was to “Amend the Income Tax Act to provide a definition of a charity which would remove the privileged status of ‘advancement of religion’ as a charitable purpose.” Local NDP MP Don Davies was one member of the standing committee.

The proposal has been overshadowed by the turmoil within the ruling Liberal Party. Finance Minister Chrystia Freeland quit Prime Minister Justin Trudeau’s Cabinet following the weekend, on Monday December 16, instead of delivering the government’s fall economic statement.

Trudeau himself announced January 6 that he will be stepping down as leader of the party; he also prorogued Parliament (which includes ending committee activity).

And it is fair to say that even if the Liberal government were not in such disarray, it is by no means clear that this government would have acted on the proposal – or another, #429, which called for no longer providing charitable status to anti-abortion organizations.

An emerging issue

However, the issue is popping up more and more, and one local organization is very invested in the proposal.

However, the issue is popping up more and more, and one local organization is very invested in the proposal.

Ian Bushfield of the BC Humanist Association posted a comment about the situation January 6, noting, “Both recommendations mirror submissions made by the BCHA in July.”

In an email to supporters the same day he said:

Last summer, we wrote to the House of Commons Finance Committee with three asks for Budget 2025:

-

- No charitable status for anti-abortion organizations,

- Remove “advancement of religion” as a charitable purpose, and

- Repeal the clergy residence deduction. . . .

Already, evangelical and conservative religious groups are in uproar over this suggestion. This is why we’re asking you to write to your MP to support these changes.

We also know that even with this recommendation, these common-sense changes still face a significant uphill battle before they become reality. This is even more true after today’s announcement that the Prime Minister is resigning and proroguing Parliament as the opposition parties threaten to push the country to an election.

However, this presents Humanists and secularists with a critical opportunity to make our voices heard among the politicians of all parties who want to present a new and different vision for Canada.

He was right, at least, about the response from Christians.

Damaging proposal

The potential damage to churches and other religious organizations – and to the nation itself – could be very significant. The prompt response by religious leaders shows how seriously they are taking the issue.

The potential damage to churches and other religious organizations – and to the nation itself – could be very significant. The prompt response by religious leaders shows how seriously they are taking the issue.

Father Raymond de Souza, writing for the National Post December 29, acknowledged that the finance committee’s many proposals were broad-ranging and non-binding:

The committee holds many hearings during the fall, inviting various experts, advocates and rent-seekers to make their case that the government should do this or that thing. . . .

The committee bundles it all up, decides what recommendations to adopt, and then reports it all to the House. Supposedly, the minister of finance takes all of this into account when drafting her budget. It’s not a careful exercise in policy analysis. The recommendations are a few lines at best, and there were a whopping 462 of them.

Liberals, NDP and Bloc Québécois on the committee all supported the report. Conservatives added a dissenting report, but did not comment on either of the items referred to here.

However, Fr. de Souza added

The second recommendation [#430] would be absolutely cataclysmic in its impact. Almost 40 percent of Canada’s registered charities advance religion.

The finance committee proposes to deny two out of every five charities their tax status. That would include the Salvation Army, which some of the committee MPs no doubt praise on their way in and out of supermarkets this season.

The committee proposes the obliteration of the charitable sector.

The Canadian Canadian Centre for Christian Charities, the Evangelical Fellowship of Canada, the Christian Legal Fellowship and ARPA Canada responded promptly as well.

Deina Warren, Director of Legal Affairs for the Canadian Centre for Christian Charities, wrote a letter to Minister of Finance Dominic LeBlanc, as well as Peter Fonseca, Chair of the Standing Committee on Finance, and Élisabeth Brière, Minister of National Revenue.

In part, she said:

It is almost incomprehensible to imagine a Canadian charitable sector absent religious organizations. Focusing solely on religious congregations (places of worship), research shows that the ‘halo effect‘ of these organizations is 10.47 times the value of any tax exemptions and credits.

In an age of declining charitable donations, regular attendance at religious services increases amounts donated and the likelihood of donations by the average Canadian. In 2010, religiously active Canadians donated an average of $1,004. Those who were not active or not religiously active gave an average of $313. Social science research confirms the essential, positive contributions of religious organizations to civil society.

Julia Beazley, Director of Public Policy for the Evangelical Fellowship of Canada (EFC) wrote a letter to Minister of Finance Dominic LeBlanc December 20, and the EFC made a statement December 31: ‘Finance Committee’s troubling recommendations on charitable status.’

Julia Beazley, Director of Public Policy for the Evangelical Fellowship of Canada (EFC) wrote a letter to Minister of Finance Dominic LeBlanc December 20, and the EFC made a statement December 31: ‘Finance Committee’s troubling recommendations on charitable status.’

The statement included this:

Committee recommendations can function as a trial balloon. If a recommendation seems widely supported, or at least not opposed, it may encourage the government to move ahead with it.

This is an important time to ensure MPs hear the concerns of Canadians about this proposal, now that the Finance Committee has put it on the table. It’s more effective to prevent these recommendations from being introduced in a bill than to ask for them to be removed once the bill has been introduced. . . .

And remember to pray for our elected representatives, speaking to them with grace, respect and humility, as we keep our eyes fixed on Christ, the founder and perfecter of our faith.

The Christian Legal Fellowship also issued a statement December 20: “CLF urges government to reject committee recommendation to remove ‘advancement of religion’ as a charitable purpose.”

ARPA Canada, which has an office in the Fraser Valley, concluded its January 8 statement with these words:

Reach out to your MP and neighbouring MPs, making it clear that this is a very bad policy recommendation that would negatively impact not just religious organizations, but also the broader communities these organizations serve.

Thus far there has been no comment from the Canadian Council of Churches.

Is religion good for society?

During a recent interview about his new book, West Coast Mission: The Changing Nature of Christianity in Vancouver (McGill-Queen’s University Press, 2024), Dr. Ross Lockhart said to What Matters Most podcast host Dr. John Martens (beginning at the 43 minute mark) that we are now living in a post-Christendom environment:

During a recent interview about his new book, West Coast Mission: The Changing Nature of Christianity in Vancouver (McGill-Queen’s University Press, 2024), Dr. Ross Lockhart said to What Matters Most podcast host Dr. John Martens (beginning at the 43 minute mark) that we are now living in a post-Christendom environment:

A missiologist like Sam Chase would make the argument that there’s something different in the Canadian zeitgeist or the spirit of the age now than say two, three decades ago. The shift that he’s observed in his work is that Christianity has moved from a default public good to one that people aren’t sure about.

His language, that I find helpful, is, it’s not that Canadians are uncertain whether Christianity is true or untrue. What they’re asking now: is it actually good for Canada.

Issues such as colonialism and mission history – particularly residential schools – are recognized by Christians and non-Christians alike as blots on the Christian story in our nation, he said.

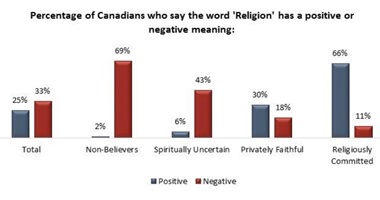

An Angus Reid Institute Spectrum of Spirituality poll in 2017 supports that view. One finding:

An Angus Reid Institute Spectrum of Spirituality poll in 2017 supports that view. One finding:

Indeed, just one-in-four Canadians (25%) selected the word ‘religion’ as having a positive meaning to them while one-in-three (33%) said they view the word negatively.

This opinion is highly variable across the four groups [Non-Believers, the Spiritually Uncertain, the Privately Faithful and the Religiously Committed].

BC may be leading the way in terms of attitudes towards religion, with activist groups like the BC Humanists, but all of Canada and the western world is going the same way.

De Souza very helpfully pointed to work that establishes the value of religious charities:

My colleagues at Cardus, keenly sensing that this absurdity was in the air, released a report last month on the socio-economic contribution of religious congregations. They have been measuring this for years.

Cardus calls it the “Halo Effect,” the dollar value of a congregation’s socio-economic contribution. For 64 Christian congregations in Canada, Cardus calculated that their Halo Effect is more than 10 times the value of the tax exemptions and credits, on average. The net-positive socio-economic contribution – Halo Effect, minus the value of tax exemptions and credits – of all religious congregations in Canada is an estimated $16.5 billion.

Even a high-spending government like the current one would find it difficult to find $16.5 billion per year to make up for lost social services, poverty alleviation and community-building.

Clearly, most churches and religious organizations need to do a better job of convincing others of their value – while some, no doubt, need to do a better job of justifying their tax-free status.

Confusion over charitable giving deadline

On a somewhat related note, the Canadian Centre for Christian Charities released a statement January 7 on a rather confused issue related to charitable giving:

We received confirmation that the Department of Finance intends to honour the December 30, 2024 announcement to extend the deadline for making donations. Legislation to extend the deadline will be introduced at the first available opportunity. Further details are expected to be released soon, including about how the extension will be administered.

The government had said in its release that it would extend the deadline for making donations eligible for tax receipts in the 2024 tax year, until February 28, 2025, in order to “mitigate the impacts of the four-week Canada Post mail stoppage.” Confusion has risen because Trudeau prorogued Parliament, meaning that the Parliamentary session is over, and no new business will be conducted.

In what might be taken as an encouraging sign, given the discussion above, the government release stated:

Canada’s charities work tirelessly to address poverty and hunger, improve socioeconomic outcomes for Canadians, and keep communities connected and informed. . . .

Quotes:

“Charities are at the heart of communities across Canada, lending a helping hand to those in need. This extension recognizes the impact that the Canada Post service disruption had on their fundraising campaigns, and will give charities additional time to receive and process donations so that they can continue their vital work.”

– The Honourable Dominic LeBlanc, Minister of Finance and Intergovernmental Affairs

“Registered charities play an important role in our society and provide valuable services to Canadians—especially the most vulnerable among us. The Government of Canada is dedicated to the strength and vitality of charities, as we know these organizations are important to the social fabric of Canada and the well-being of Canadians.”

– The Honourable Élisabeth Brière, Minister of National Revenue

Quick facts

-

- There are approximately 86,000 registered charities in Canada, each carrying out activities in support of one or more of the four recognized categories of charity – the relief of poverty, advancement of education, advancement of religion and other purposes beneficial to the community.

- The Government of Canada understands that registered charities are an important part of Canadian society, and it encourages Canadians to donate generously through the Charitable Donation Tax Credit for individuals and the deduction for charitable donations for corporations.

The B.C. Catholic posted an article January 6 which goes into the confusion surrounding the matter.

May 5, 2025 note: Sherry Griffin of Lighthouse FM interviewed Barry Bussey on the topic, ‘Could you church lose its charitable status.’ Bussey was formerly director of legal affairs for the Canadian Centre for Christian Charities and is now President and CEO of First Freedoms. He wrote The Status of Religion and the Public Benefit in Charity Law (Anthem Press, 2020).

To know God means that you know God does exist. The living God does not prefer the use of protesting at all , which God calls (mauling) which is carnal. Best to have a yearly waiver to every church, for to have no public protest of anti-abortions for a taxable charitable donations would be the will of God.

If this holds then the federal government must block all out of country funding for mosques, Islamic schools in Canada and should also include removing the charitable tax status for all ‘humanist’ organizations too as ‘humanism / atheism’ is a religion!

And the government will need far more taxpayer funding for welfare / food banks and immigration support to replace the charitable contributions of churches.

If religious organizations are going to lose charity status, then this should apply to all religions and not just Christian organizations. If this is just applying to only Christian organizations, then we all know what is coming next . . . outright discrimination against Christians.

It is just a matter of time in these last days, when Jesus predicted growing times of trouble for the saints, as the world sinks into the times of Sodom and Noah before the great and terrible Day of the Lord.

This is a very concerning topic. Thanks for bringing it to our attention Flyn.